TDS challan 281 is the challan Paid by the corporate payers

This challan consists of sections 194 A, 194 I, 194 J, 192 etc

and using this we have to pay the tax online using online banking

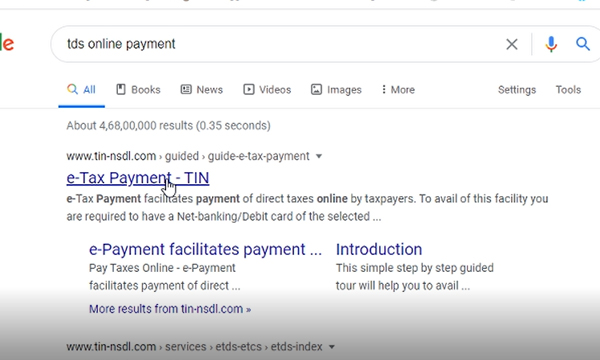

Step 1:

Open a search engine and search TDS online payment which will appear a below-shown photo

Step 2:

Click on the e payment – TIN then the screen shown below will be opened there in the right bottom corner we will find click to pay tax online.

Step 3:

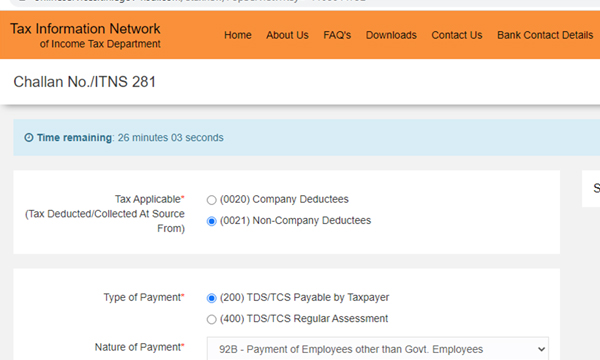

Then click on the TDS/TCS Proceed tab.

Step 3:

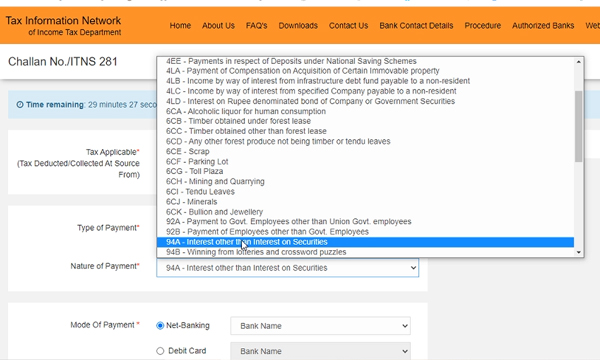

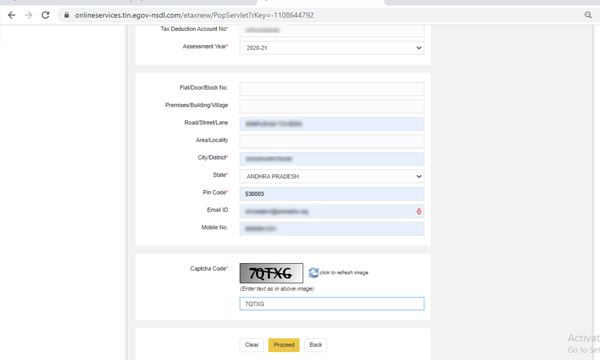

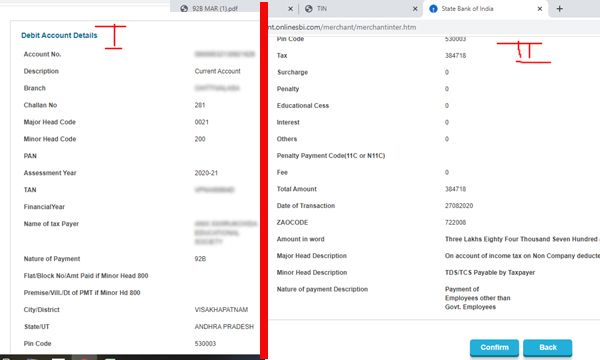

Check the applicable boxes and select the appropriate section and click on proceed to fill every particular and click on proceed

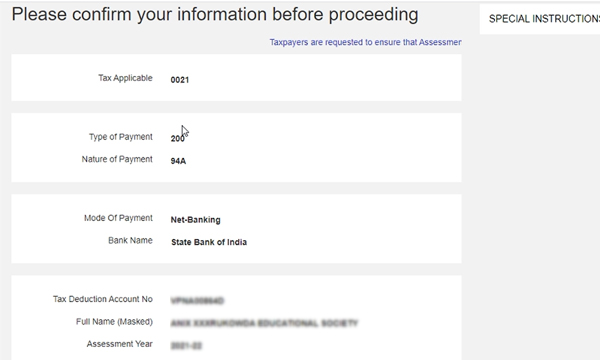

Then we will have to confirm the details and mode of payment

Step 5:

check the I agree and click on “Submit to the bank”

Step 6:

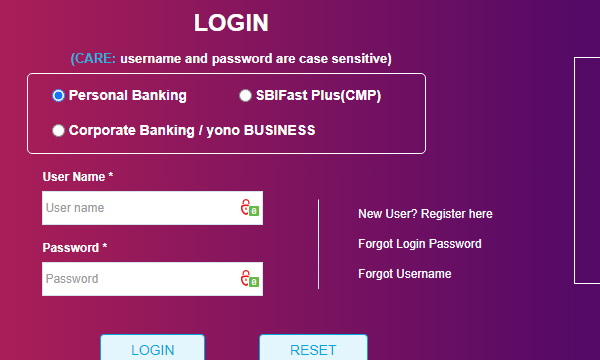

It will direct to the bank page and select the appropriate icon either “internet banking” or “ATM ”

Step 7:

log in to your internet banking profile and accept the amount given on the page and check the details and confirm the same.

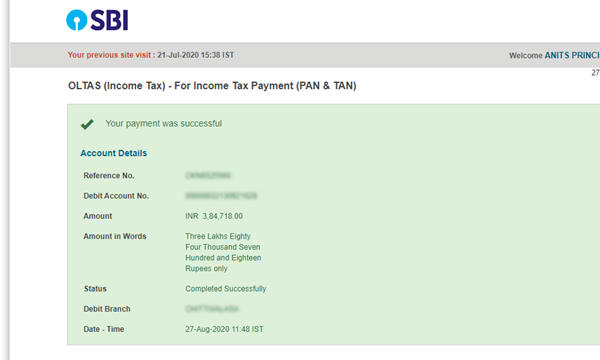

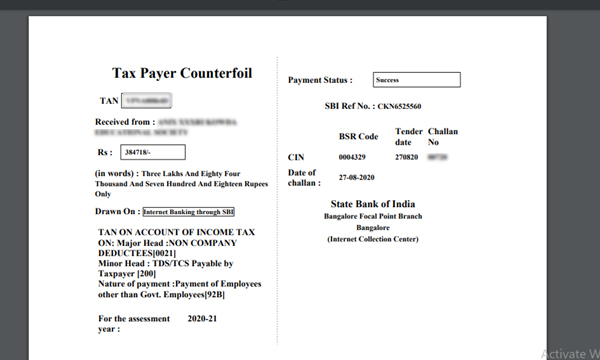

Step 8:

Then the successful tab will appear with a successful status.