After the declaration of the finance bill, 2021 many queries are raised from the individuals regarding which is beneficial and which is not beneficial. Which option is to be chosen between both the regimes. Here is the choose the option in form 16 F.Y.2022-23 for the old and new tax regime calculator.

Here is the latest download From 16 Excel format for Fy 2022-23 (income tax calculator for salaried employees ay 2023-24) with automatic calculations made according to the latest amendments in income tax rules.

Form 16 for Income Tax in India

Form 16 is a document issued to every tax-paying salaried employee by the employer. Form 16 consists of TDS details of salaried employees. Form 16 is also known as the income tax calculator, based on the information provided by the employee in form 16 the TDS of employees will be calculated. Every salaried employee who is under income tax slab rate must file form 16 every year. Here you download form 16 part A excel formate and form 16 part B excel formate

Also read: Investment Declaration Form For AY 2022-23 In Excel Format

Form 16 Eligibility Salary

The eligibility salary limit for form 16 for an employee is 250000 Rs i.e employees whose annual income for a financial year is above 250000 Rs need to submit form 16 to their employer. If an employee has worked with Two employers in a financial year they need to submit Two forms of 16 copies to their employer. The eligibility salary limit for form 16 varies for senior citizens and very senior citizens.

Present Income tax slab rates for A.Y. 2022-23 (F.Y.2021-22)

New Regime Tax slab rates :

All Individual Employees (Citizens, Senior Citizens & Super Senior Citizens)

| Slab | Rate |

| 0 – 2,50,000 | Nil |

| 2,50,000 – 5,00,000 | 5% |

| 5,00,000 – 7,50,000 | 10% |

| 7,50,000 – 10,00,000 | 15% |

| 10,00,000 – 12,50,000 | 20% |

| 12,50,000 – 15,00,000 | 25% |

| > 15,00,000 | 30% |

Existing (old) Regime Tax slab rates :

Form 16 Excel format for ay 2022-23 (fy 2021-22):

Every employer issues form 16 to the employee when TDS Deducted from the salaries of employees. When the employee files his Income Tax return, then form 16 should be taken from the employer, where the tax deducted and deposited details are certified. Form 16 has two parts they are Part-A and Part-B.

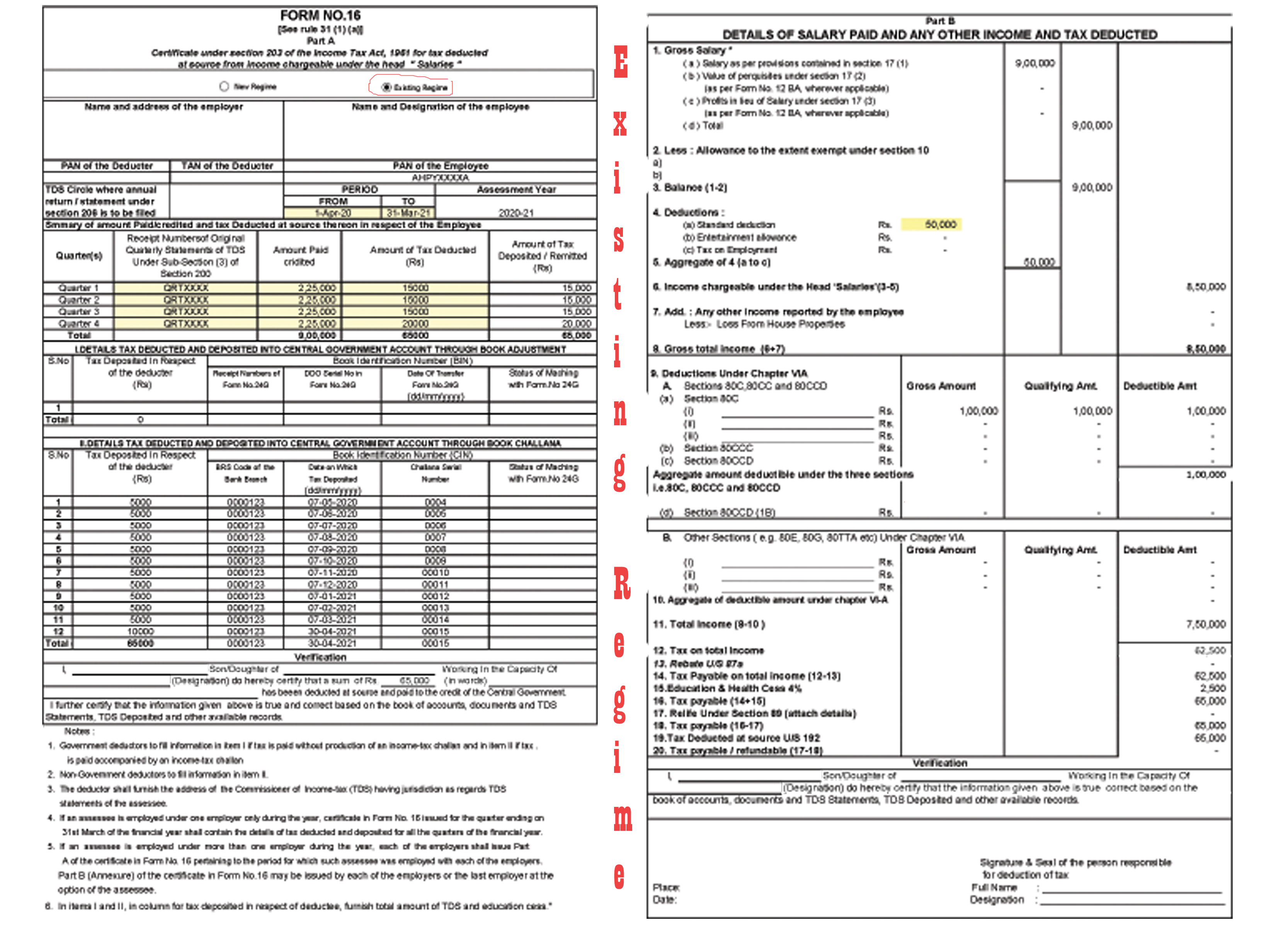

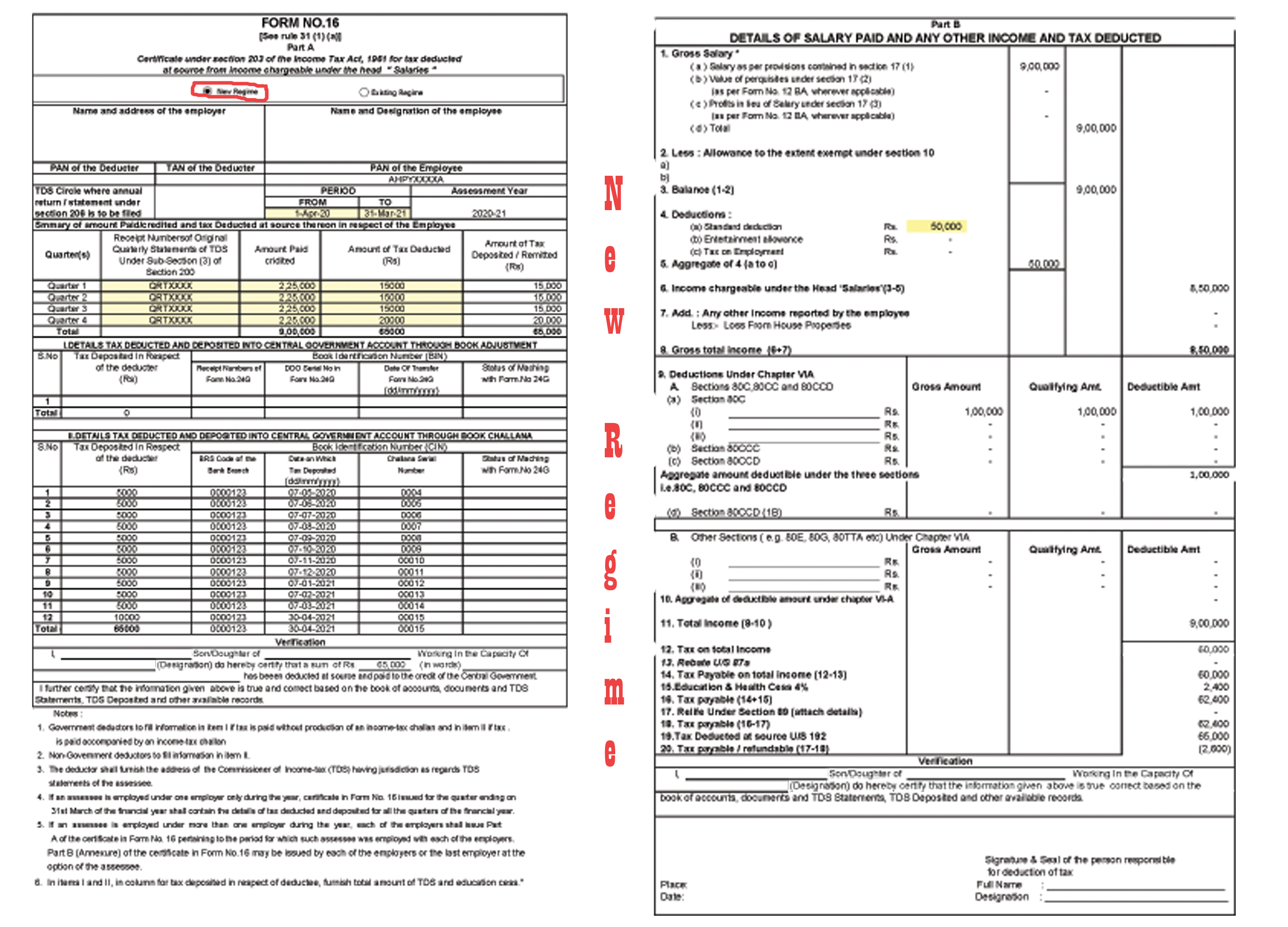

Part -A of form 16 consists of Employer details like Employee Name, Pan Number, Designation, Department, and Q1, Q2, Q3, & Q4 (salary and TDS) details. In Part-B we need to fill in the Gross Salary Details, HRA, Transportation allowances, Chapter IV saving details.

Details need to be filled in Part A & Part B Of Form 16:

How to fill form 16 for salary with the example

Form 16 Existing Regime Tax part A & Part B in excel format ay 2022-23 (fy 2021-22)

Form 16 New Regime Tax part A & Part B in excel format ay 2022-23 (fy 2021-22)

The below you can Download Form 16 in excel format for A Y 2021-22 :

↓Download Form 16 In Excel With Automatic Calculations 2020-21

Download Form 16 In Excel With Automatic Calculations 2019-20

Additional information related to Form 16

Is it mandatory to file Form 16

Employees can file ITR directly but it is always advisable to submit a form 16 to your employer and file ITR through your employer.

What is the difference between TDS and form 16?

TDS means the amount of tax incurred on your source of income and whereas form 16 is a TDS certificate that consists of both your incomes and TDS details which you need to submit to your employer.

Can I get my form 16 online

Employees can’t able to download their form 16 online, so whenever you need your form 16 get it from your employer, your employer can download it from the TRACES website by using their TAN. If you want to know your TDS details then download form 26AS from TRACES.

Also read: Relief under section 89 with example

What is TRACES

TRACES stands for TDS Reconciliation Analysis And Correction Enabling System, which allows individuals to correct their already submitted TDS details online.

Here is the link to the TRACES Website

Due date to file income tax return filing for F.Y 2022-23

In general, the due date to file an income tax return filing for Ay 2022-23 is 31 Jul 2023

If you have any queries on how to fill Form 16 in Excel format for AY 2023-24 (FY 2022-23) then ask those queries in the comments section below.

it is one the best calculator for salary holder to calculate income tax through this so thanks lot

Is medical allowance received from the employer be eligible for standard deduction.

Once a person claiming Deduction as standard deduction cannot claim any other allowance as a deduction

form 16 year 2019and2020

12. Tax on total Income is Rs. 1179, 13. Rebate U/S 87a is Rs. 12500, 12500 is greater than 1179,

Rebate U/S 87A should be Rs. 1179?

You get rebate 1179/-

Really very good Form-16 prepared by you. it is really helpful.

Income tax TDS form 16a

IT IS VERY USEFUL

GOOD EVENING SIR/MADAM,

WE NEED UPDATED KNOWLEDGE OF INCOME TAX. PLEASE SEND THE ALL UPDATED NEWS AND FORMS OF IT.

WITH BEST REGARDS,

RAMAJYOTHI M,

PO AND ADMIN.OFFICER.