If you have given the wrong financial year (FY), or section codes, or major heads while paying TDS challan 281 in OLTAS then you have an option to correct those mistakes.

Here are some examples for that:

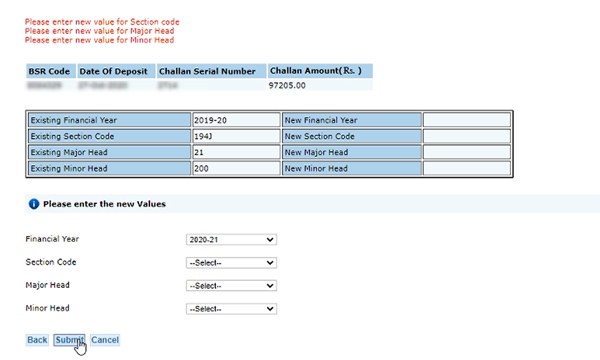

1.When you entered wrong f.y.2019-20 instead of 2020-21.

2..When you filed under Section code 94J instead of 94C.

3.When you have field major head 20 instead of 21

4.When you filed minor head 400 instead of 200

How to change the financial year in the TDS paid challan 281

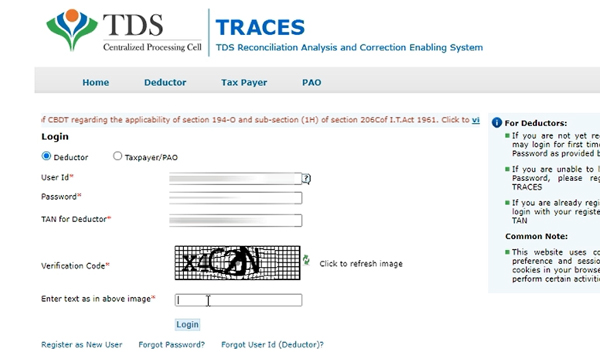

Step-1: Go to traces website www.tdscpc.gov.in and login with your details.

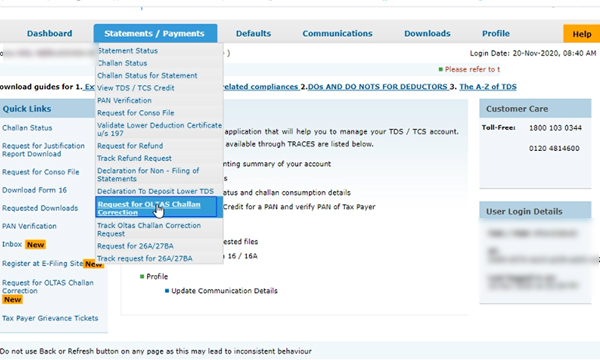

Step-2: Now below-shown tab will appear with some tabs. Go to the statements/payments tab and click on request for OLTAS challan correction.

.

.

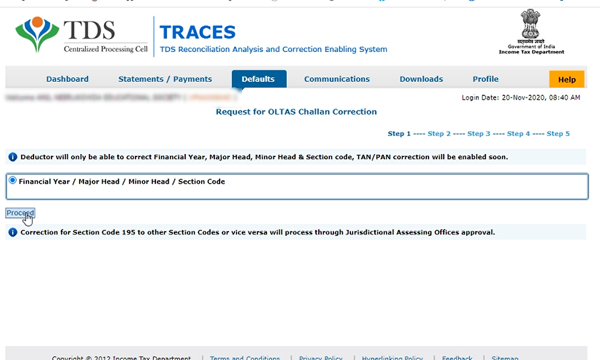

Step-3: After clicking the request for OLTAS challan correction it displays OLTAS challan correction-check list, now click on proceed.

Step-4: Now choose the financial year, Major head, minor head, and section code option and click on proceed.

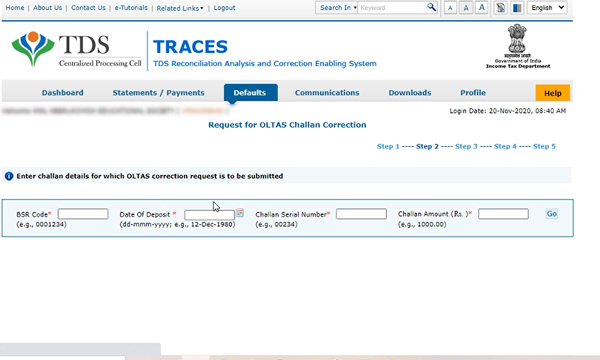

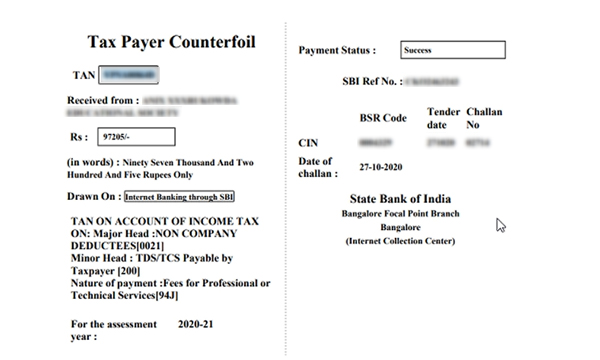

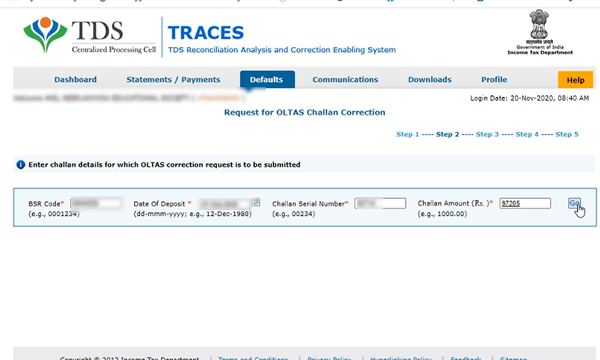

Step-5 : Fill the following OLTAS challan details for which you want change the details.

- BSR code

- Date of deposit

- Challan serial number

- Challan amount

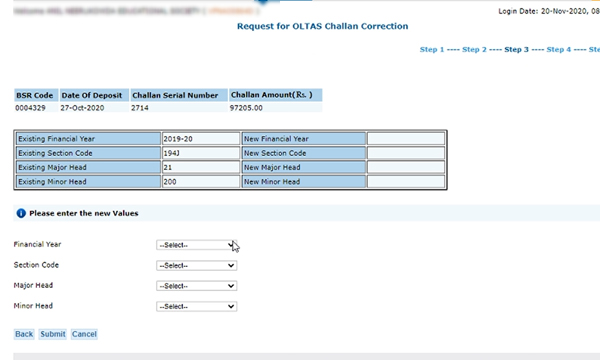

Step-6: Now all the challan values display. (financial year, section code, major hear and minor head).

Step-7: You can make changes in single or multiple fields. A dialogue box will appear there, you have to enter the new value of those fields and click on submit button.

Step-8: Verify the new changes and click on confirm button.

Step-9: After confirmation, you will get the reference number.

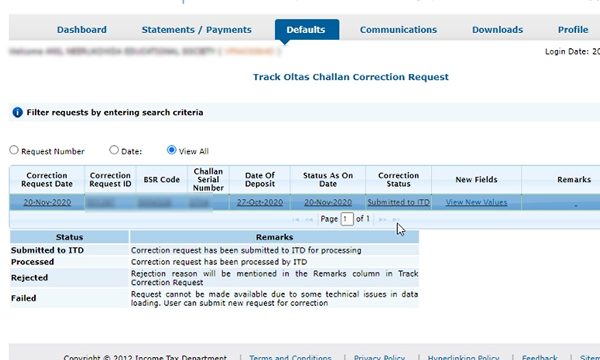

Step-10: Track your OLTAS challan correction request under statements/payments tab.

Step-11: In below picture you can see the correction status