Invoice details can be sent to registered dealers through Furnishing Facility (IFF) instead of GSTR-1 on the return dashboard.. If there are no B2B sales then there is no need to disclose further details in IFF..The B2B details so disclosed may not be re-communicated by the Quarterly GSTR-1, as the details provided by the IFF are disclosed in the recipient’s GSTR 2A & 2B.GSTR 1 Careful consideration should be given to the details of B2B dealers in the IFF for the previous two months, once again, and not to repeat pre-uploaded bills. We have some changes in HSN Code-wise summy in GSTR-1 Portal from 01-May-2021 onwards. we have to give the details HSN Code wise summary with GST rates. Here we know how to file GST IFF return offline with new changes.

Step by step GST IFF return offline process :

Step-1 :

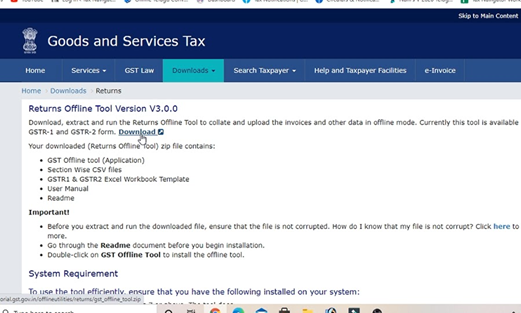

First, we have to download GST offline tool latest version

Step-2 :

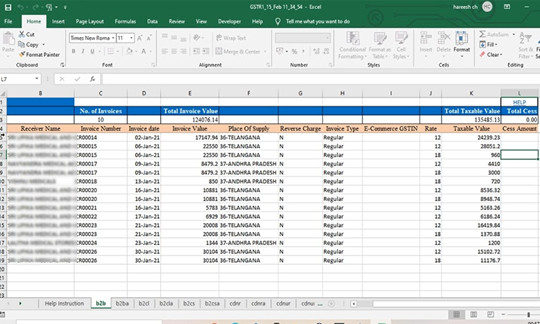

After complete download, unzip the download file and open the GSTR-1 excel file.

Step-3 :

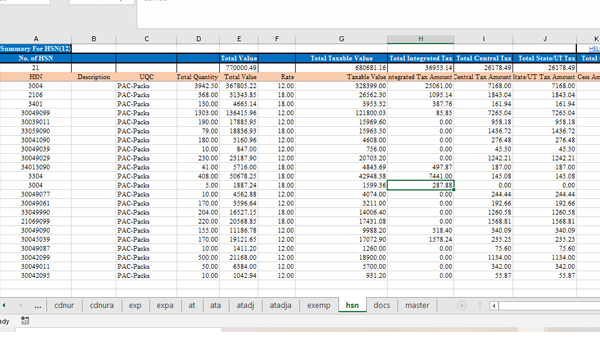

We have to fill the B2B (Sale to Register persons) invoice details & HSN Code wise with GST rates in the below excel format.

Step-4:

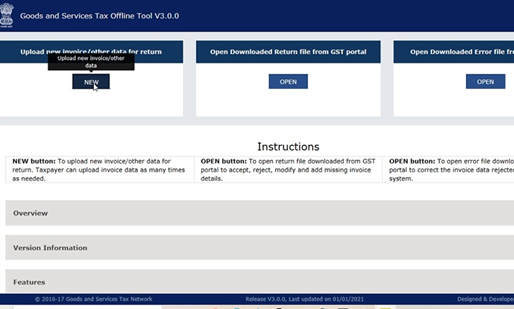

After filling in the B2B invoice details in excel we have to open the GST offline tool and click on a new option like appears on the below screen.

Step-5 :

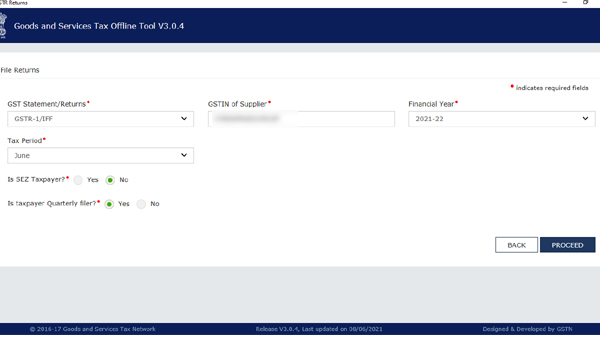

Given the below details after clicking on a new option

1.Scroll down the GST returns box and select the FSTR-1 IFF

2.GSTIN of supplies

3.Financial year

4.select to yes button for the Quarterly filer

After filling in the above details click on proceed button.

Step-6 :

Click on the import excel option for uploading an excel file.

Step-7:

After uploading the excel file you will see details as shown in the picture below and click on generate file option for JSON file to upload in the GST portal.

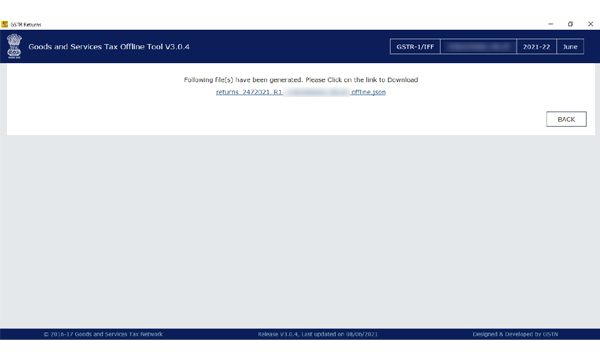

Step-8:

Here generate the JSON file.

Step-9 :

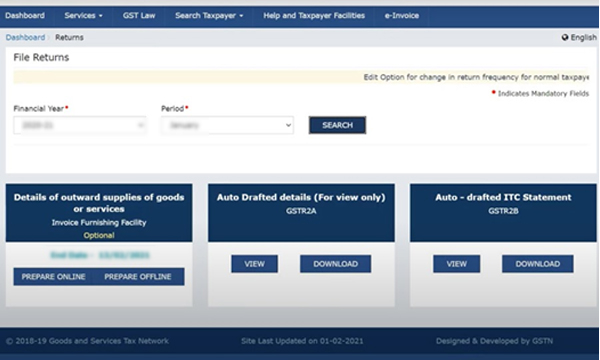

After generating a JSON file we have to login in GST portal and go to the return period click on prepare offline option.

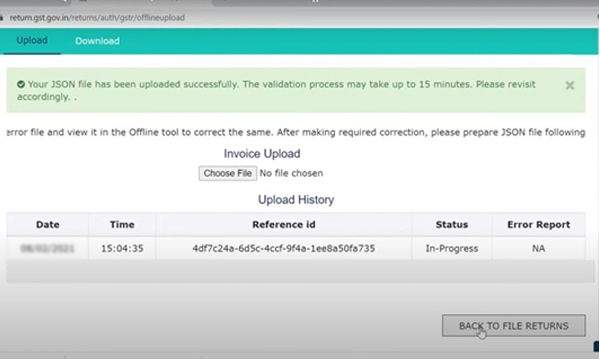

Step-10 :

Here click on choose file option and upload the JSON file. After uploading the JSON file show the status like appears below the picture.

Step-10 :

After 15 minutes we have to go to GST IFF online and click on generate IFF summary

Step-11 :

After click on generate IFF summary, we have to see the invoice amount in the B2B box.

Step-12 :

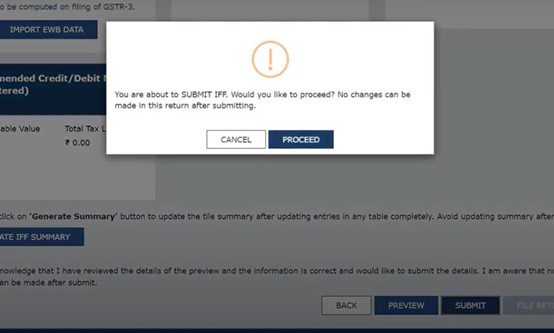

After checking the B2B invoice details we have to click on submit button. Once you click on submit button no changes can be made in this return.

Step-13:

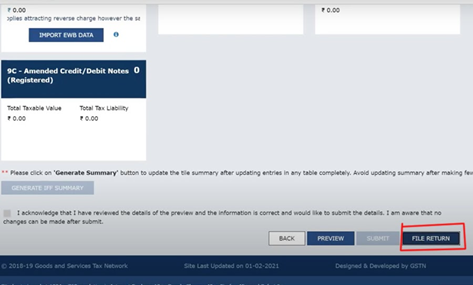

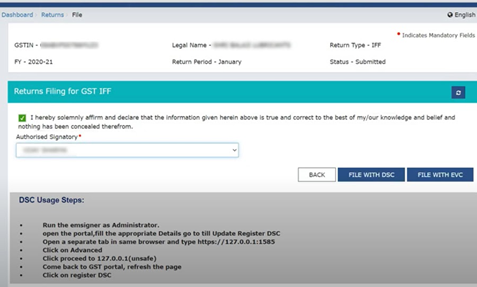

After submitting the return we file the return through DSC or EVC.

Step-14 :

If we want to file the return through EVS we get OTP from registered mobile enter the OPT number in the box click on verify option and show the successful filed in the GST portal.