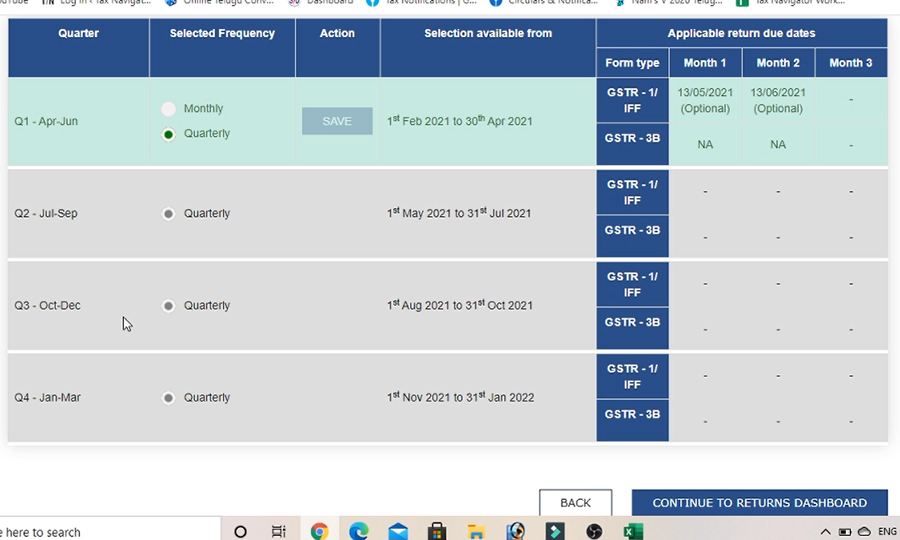

QRMP filling with effect from 01.01.2020. This option helps to whose turnover is less than 5 crores, small taxpayers eligible for this scheme. Taxpayers who have changed or converted to Quarterly Option must file GSTR-1 & 3B simultaneously for a period of 3 months.

For example, GSTR-1 & 3B for the quarter-January to March-2021 will appear in April-2021. We uploaded B2B invoices in GSTR 1 IFF every month it is optional, not mandatory to file but tax paid monthly through challan.

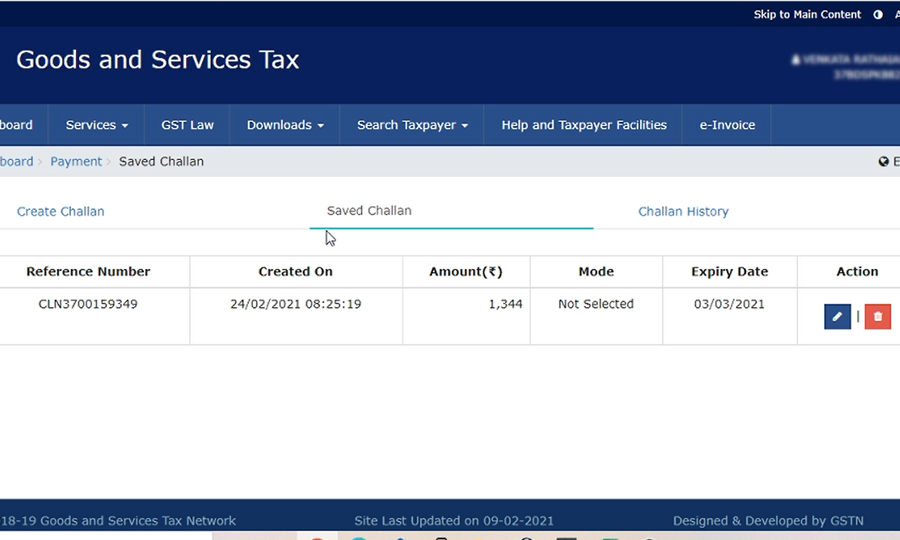

Here we know step by step monthly challan payment process under the QRMP scheme

Step-1: Login to GST portal.

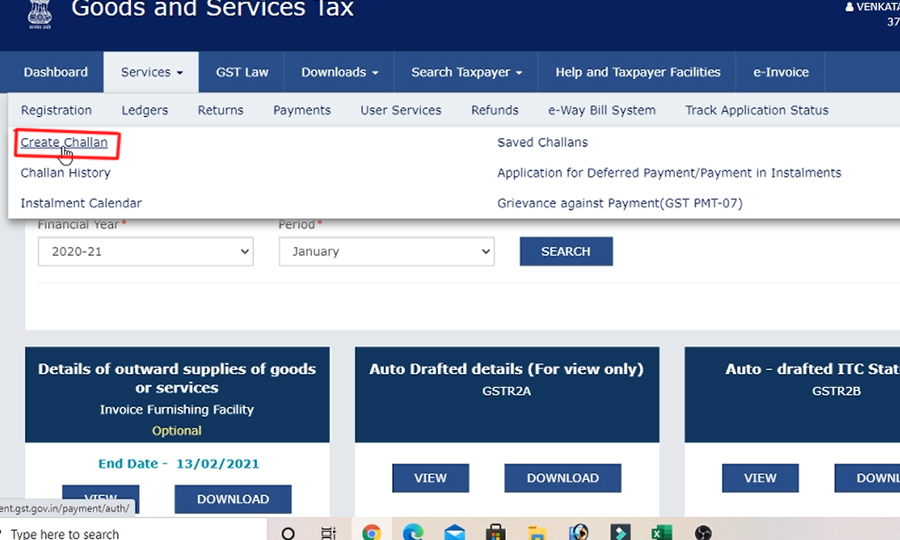

Step-2: Go to the ledgers tab and click on create challan.

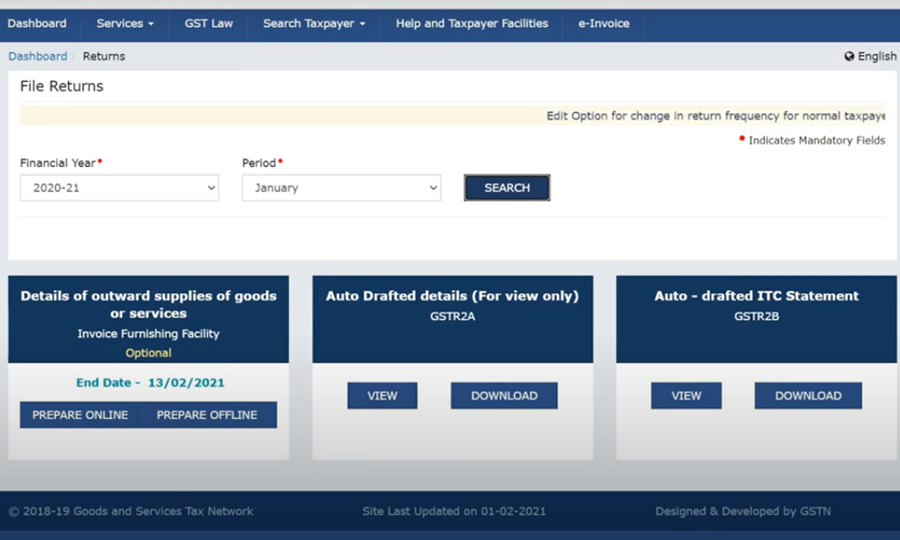

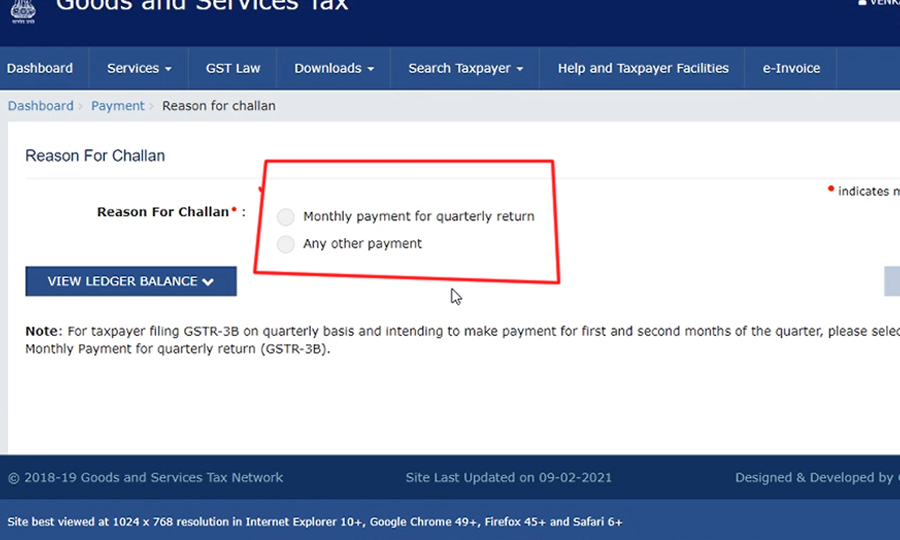

Step-3: The below picture will appear with two options, one is a monthly payment for quarterly return and another one is any other payment. We have to click on a monthly payment for a quarterly return.

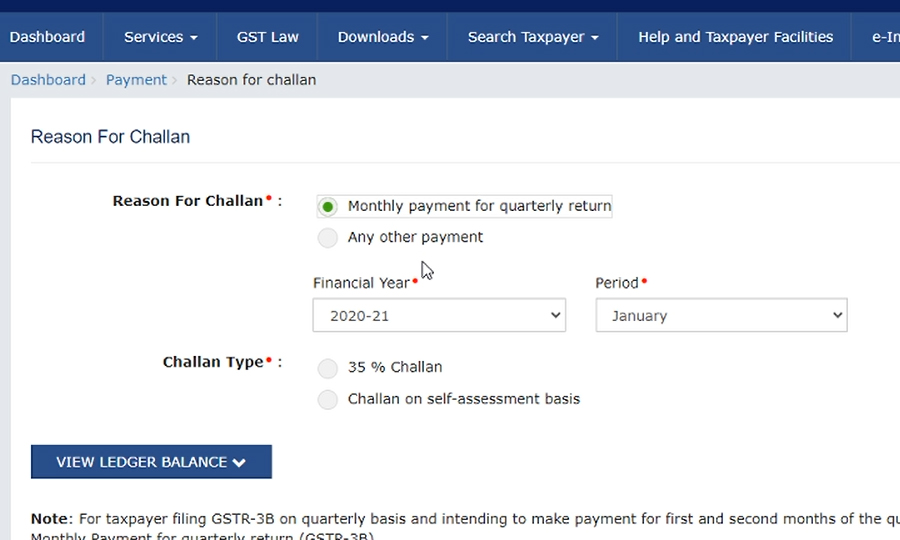

Step-4: After clicking on the monthly payment for quarterly return option, now select the financial year and period in which month you have to pay tax

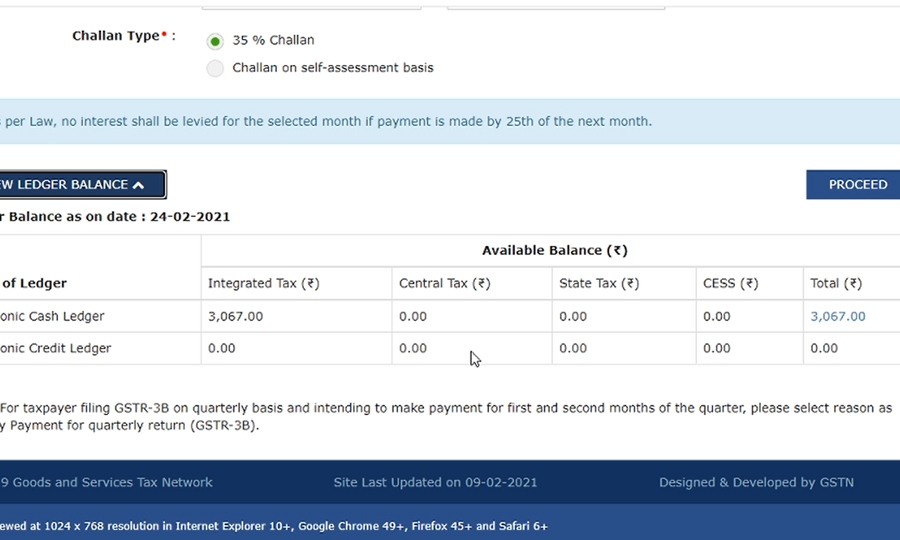

Step-5: If you want to see the cash ledger balance click on the view ledger balance.

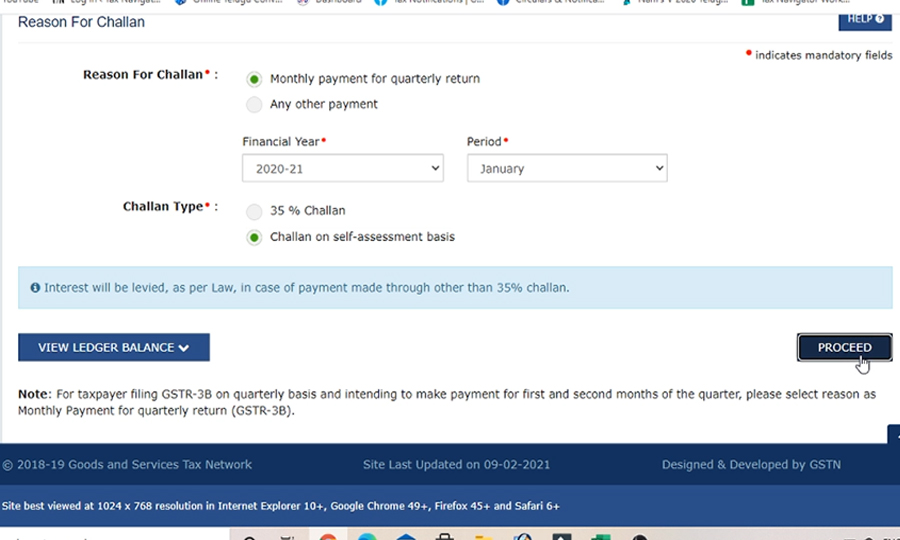

Step-6: The below picture shows the reason for the challan. You can click on the monthly payment for quarterly return option. Then after you can see two options below one is 35% challan other one is Challan on a self-assessment basis.

Amounts will appear automatically if the 35% Challan option is taken. Those who do not want to pay 35% challan have to take the option of Self-assessment Basis available there and deduct ITC from the tax payable on actual sales and pay the tax Amount if they still have to pay tax. Due date of tax subsequent month is 25th.

Step-7: Here we want to pay self-assessment tax. So fill in the actual tax amount and pay it through the net banking or RTGS/NEFT

Also read: Intimation of voluntary payment under GST form DRC 03.