Every deductor deducts TDS from the deductee and that TDS amounts every month are paid to the government and file TDS returns every quarter on the income tax website. After filing the TDS return you can find out some mistakes through the justification report and you need to download the console file for the revised TDS return. Here you know how to revise TDS return using a consolidated TDS file.

Find out reasons for revised TDS returns :

- Wrong pan number

- Update missing deductee details

- add challan

- When one person’s PAN number is given to another’s PAN number

- wrongly given challan number, BRS code and challan date

3 Stages for revised tds return using consolidated tds file

- Dowload challan file csi format

- Download cosolidated file

- Download latest RUP version from OLTAS

1.How to download tds paid challan from oltas

Here following steps for how to check OLTAS challan status and download the challan file in csi format

Step-1 :

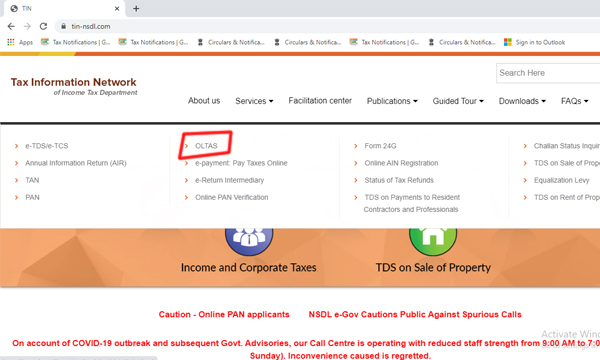

Search tin-nsdl.com in google chrome

a screen will appear will showing tin-nsdl.com (https://www.tin-nsdl.com/services/oltas/oltas-challan.html)

Go to serives and click on OLTAS option

Step-2 :

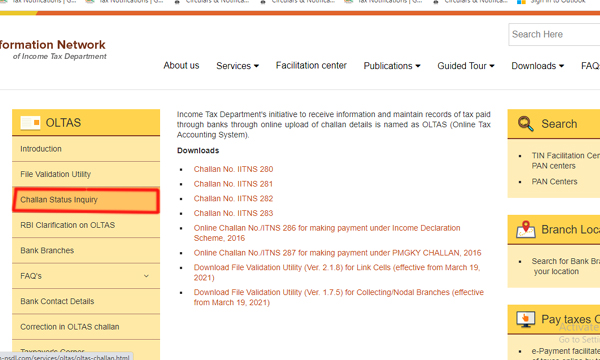

Then the below-shown tab will appear with some tabs

Click on Challan Status Inquiry tab

Step-3 :

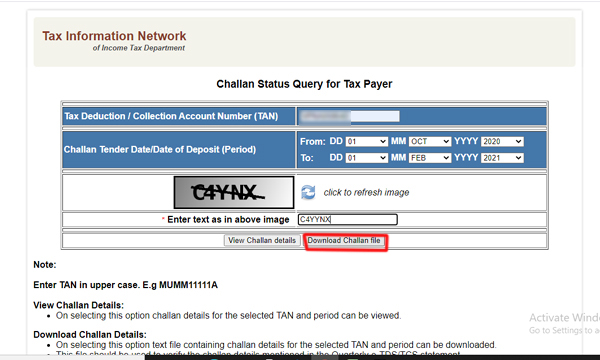

Here you can click on TAN Based View

Step-4 :

The below stage you give the TAN number and Challan deposit period. After fill the details you have to click on Download Challan file then you can download csi file.

2. How to download consolidated tds file from traces

Here the following steps for how to dowload coslidated file from traces throgu degital sign

Step-1 :

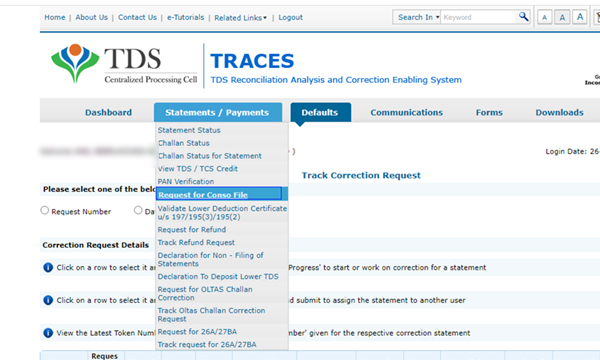

Login to https://tdscpc.gov.in/ with your username and password

Click on Statements / Payments tab, scroll down to select the Request for Conso file.

Step-2 :

Which quater you want to revised tds return here give below the details and click on Go tab.

- Financial year

- Quater

- Form type : 24Q / 26Q

Step -3 :

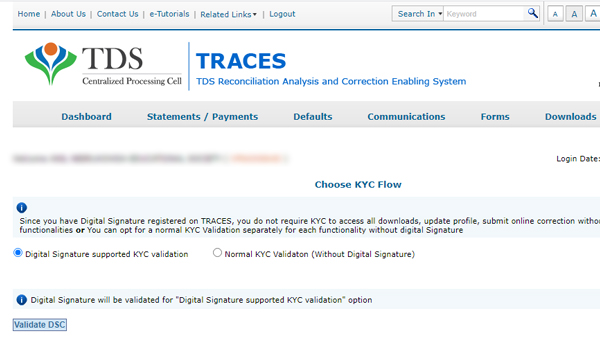

At this point, we have to validate either with DSC or Normal KYC (OTP)

Step-4:

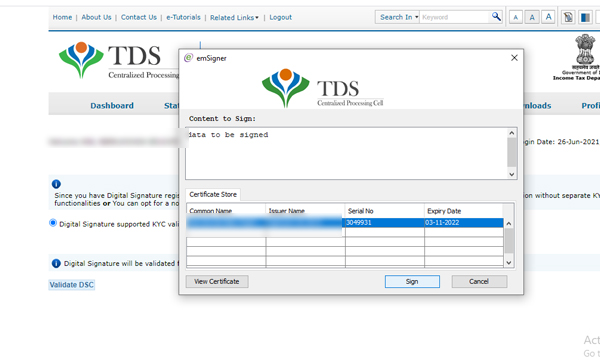

DSC: Insert DSC and a dialogue box will appear there we have to enter the password. Then we have to select the name of the token

Step-5:

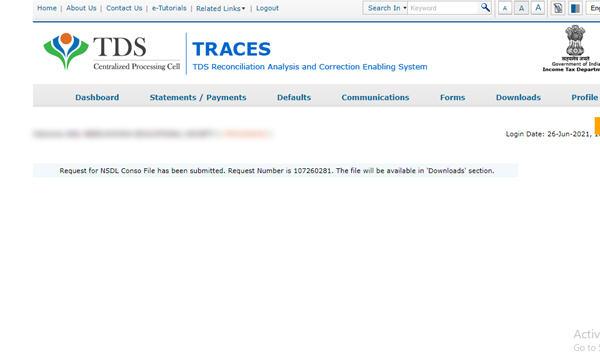

Request for NSDL Consofile has been submitted. You get the request number and the file available in download section.

Step-6 :

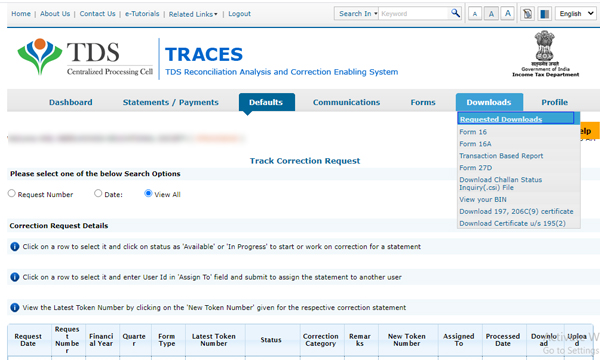

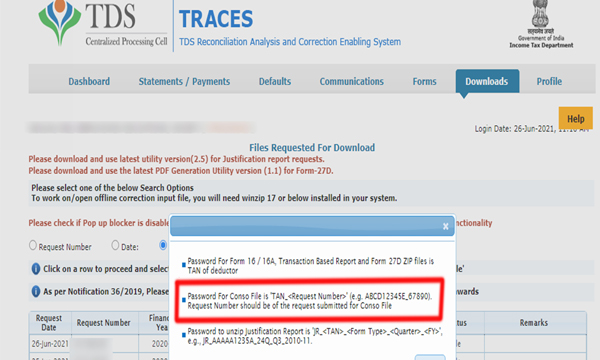

Now again on the home page go to requested downloads

Step-7 :

Then a tab with Three checkboxes will appear with that we can search with the request number or with a date or with a view all by checking the check box.

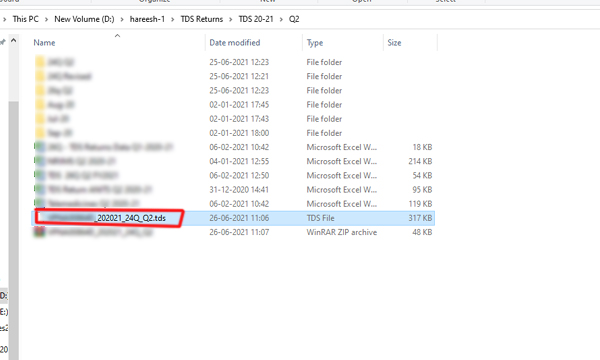

on clicking the below-displayed item a ZIP file will be downloaded

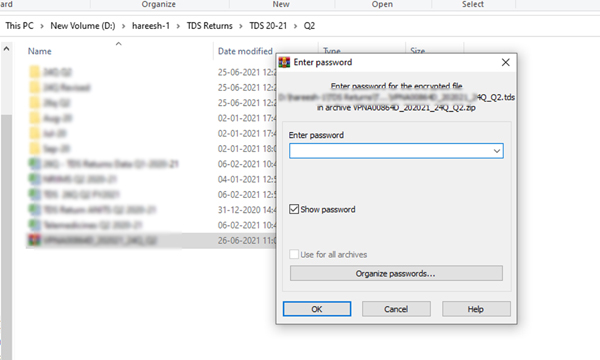

Step-8 :

For unzip for conso file need to password

Step-9 :

Here entre the password for upzip consofile is TAN Number and request number (e.g.ABCD12345E_67890)

3. How to file tds correction return through nsdl using RUP Utility latest version

After download the challan file and conso file, you have to revise the TDS return using the RUP utility. The following steps for revised TDS return through the latest RUP utility.

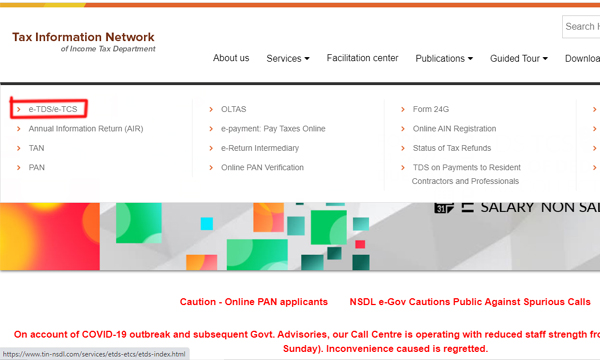

Step-1 :

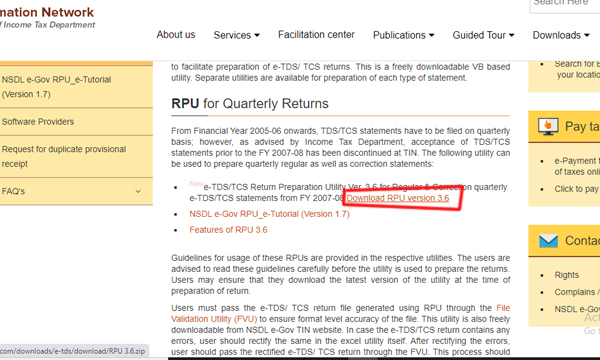

here we need to download latest RUP utility in tin-nsdl web site.

Search tin-nsdl.com in google chrome

a screen will appear will showing tin-nsdl.com (https://www.tin-nsdl.com/services/oltas/oltas-challan.html)

Go to serives and click on e-TDS/e-TCS option

Step-2 :

Here dowload RUP latest version

Step-4 :

After downloading RUP file we can open the TDS_RUP

Step-5 :

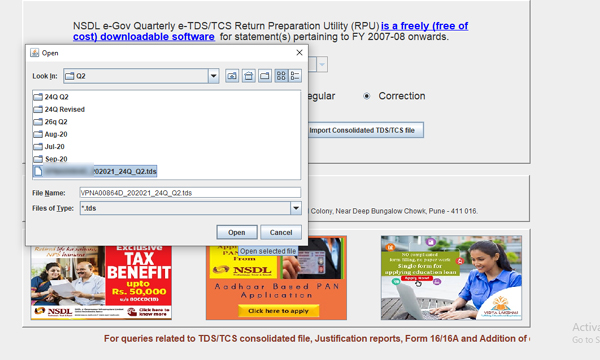

You can select the correction option and click on import Consolidated TDS file tab

Step-6 :

Here you can upload the download conso file

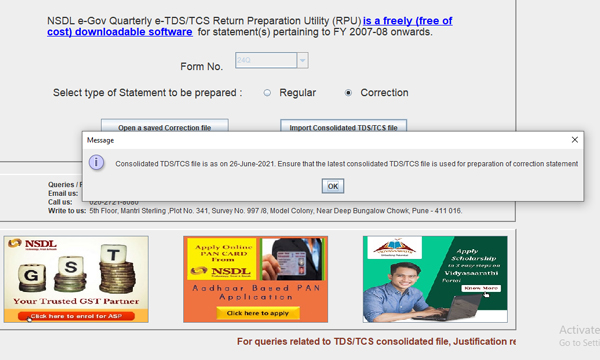

Step-7 :

After uploading the cosolidated tds file you see all that has previously been filled in the TDS return.

Step-8 :

Here you can click on the Challan tab then see you added challan

Step-9 :

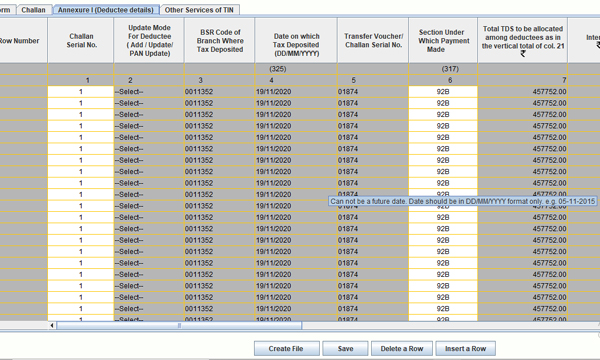

You have to click on Annexure I to modify (or) adding the deductee details like PAN number, Gross amount, and TDS amounts.

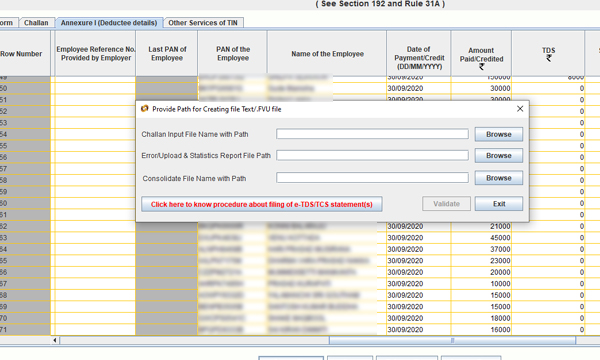

Step-10 :

After modify deductee details you have to click on create file then show disply like below picture. you can upload path csi Challan added file,consolidated file and you can give the browse address for download fvu path (Statistics report file path).

Step-11 :

After successfully creating fuv file and form 27A you can submitted revised TDS return file through offline or online