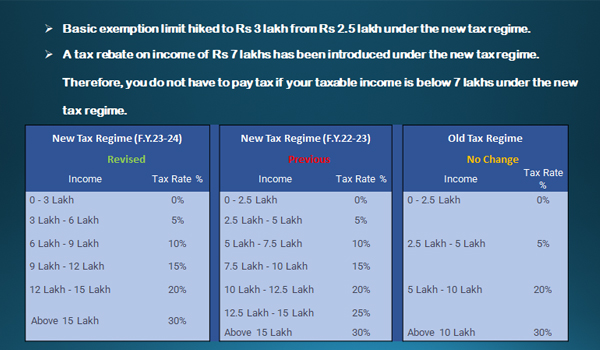

As per section 115BACC of the income tax act, individuals and HUFs can opt for a new tax regime at lower tax rates. Based on your annual income and investments, you have to choose your tax regime. It is always recommended to calculate the tax difference under both tax regimes (New & Old) to decide which is best for you.

Download the below new vs old tax regime Excel sheet to know how much tax you can save by choosing the right tax regime.

Which Tax Regime is Better Old / New?

If you do not have many deductions and exemptions, then you can select a new tax regime that may be a better option. You have more deductions & exemptions you can choose the old regime.

Important Points to Remember to Choose a New or Old Regime:

- You can choose to opt for the new or old tax regimes for the entire financial year. You cannot switch between the two regimes during the year.

- If you choose the new tax regime, you will not be able to claim any deductions or exemptions under the old tax regime.

- If you choose the old tax regime, you will still be subject to the new tax rates for any income that exceeds the highest tax slab under the old tax regime.

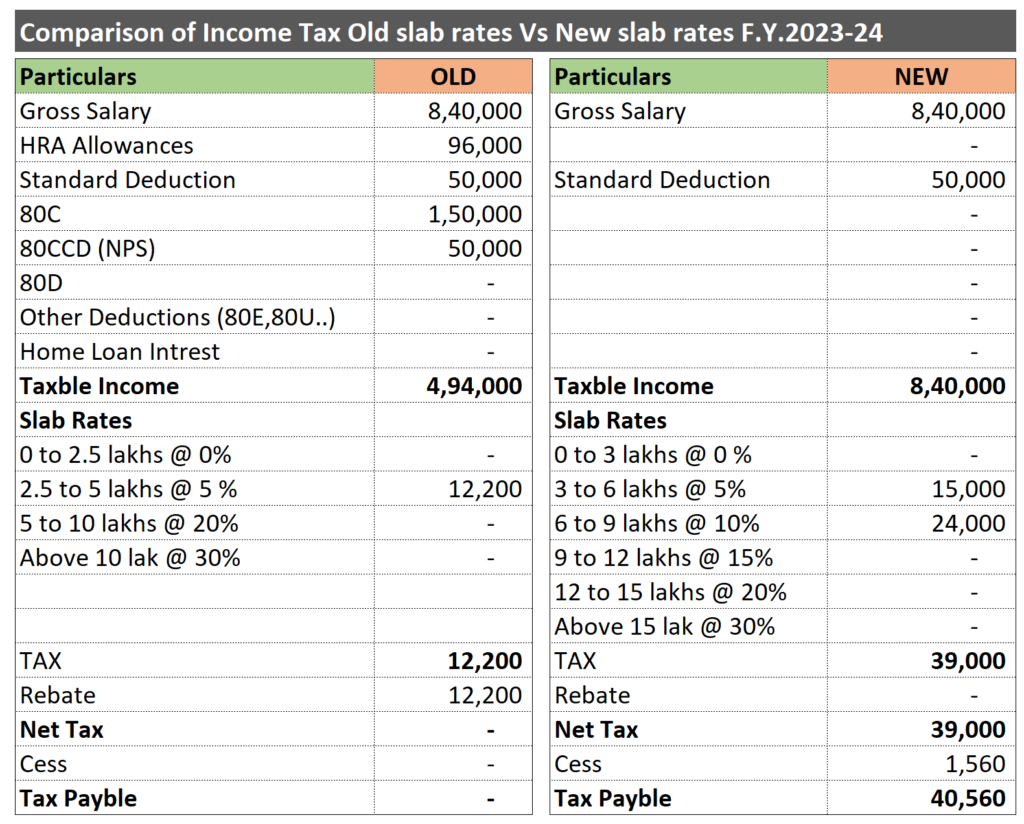

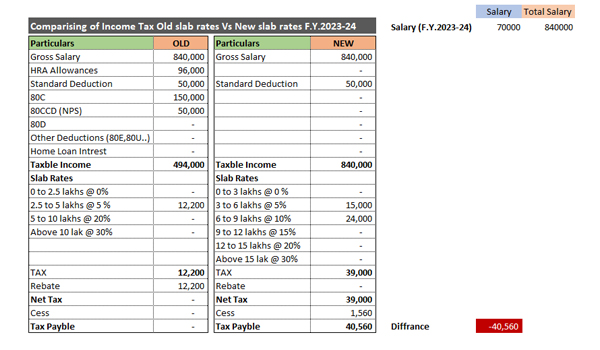

- Let us have an example for the calculation of tax for an individual having an income of 8,40,000

Example 1 :

Annual income 8,40,000, HRA 96,000 80C 1,50,000, 80D 50,000, NPS 50,000.

If the individual opts for the old regime with deductions the following is the amount of tax Zero

If the individual opts for the new regime without deductions following is the amount of tax 40,460/-

When there are deductions the old regime is preferable if there are deductions.

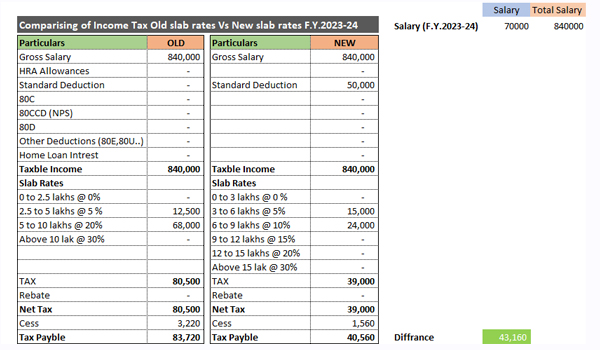

Example 2 :

If the individual opts for the old regime without deductions the following is the amount of tax 83,720/-

if the individual opts for the new regime without deductions following is the amount of tax 40,560/-

When there are no deductions the new regime is preferable if there are no deductions.

FAQs

To calculate the difference between the new and old tax regimes, the new regime calculates taxable income without any deductions & exemptions, and the old regime calculates taxable income with deductions & exemptions. Then you can find out the difference of the tax old regime vs new regime.

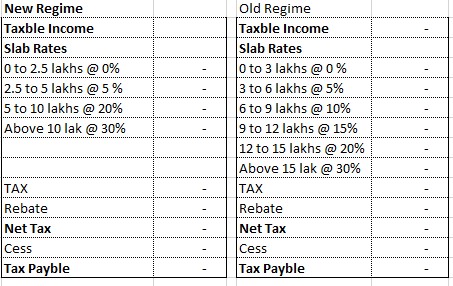

You create excel file like below format for calculate tax slabs.

Net Income =Total Revenue – Total Expenses.

You can change accordingly if the tax rates change every year.

Yes, you switch from the new regime to old regime only having salaries income does not have business & professional income.

Recommended: