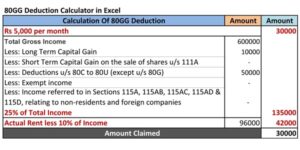

80GG Deduction Calculator in Excel

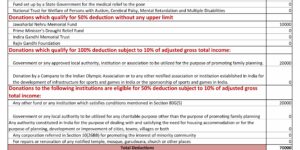

In the normal scenario HRA forms part of your salary and you can claim the deduction for HRA. If you are not a receiver of HRA from your employer and make payments towards rent for any furnished or unfurnished accommodation occupied by … Read more