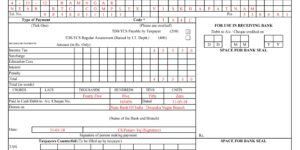

How to Fill the TDS Payment Challan 281 Excel Format

Income Tax Department introduced three types of challan they are Challan.No.INTS 280, Challan.No.INTS 281, Challan.No.INTS 282. Challan.No.INTS 280 used for depositing TDS (or) TCS. TDS Means Tax Deducted at source and TCS means Tax Collected at source. Challan 281 deposited from Corporate or … Read more