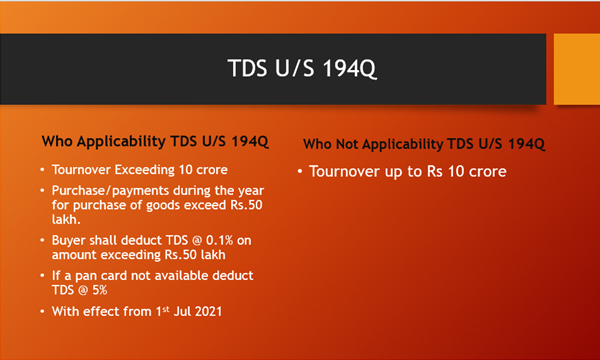

The Finance Act, 2021 introduced a new Section 194 Q which came into effect from 1st July 2021. The provisions of this new section require the specified buyer to deduct TDS on the purchase of goods from the resident seller.

What are Different Provisions of section 194Q

- The Term “Buyer”

- Time of TDS deduction

- Rate of TDS deduction

- Exemption available under section

1. Provisions relating to deduction of TDS on purchase of goods if-

- The buyer is making payment of a sum to the resident seller; and

- Payment is to be done for the purchase of goods of the value or value aggregating exceeding Rs. 50 Lakhs.

2. As per section 194Q, the term ‘buyer’ means as under –

- A person having Gross receipts/ Total sales / Turnover exceeding Rs.10 Crores in the immediately preceding Financial Year in which the specified purchase of goods took place.

- A person notified by the Central Government will be excluded from the term buyer.

3. As per section 194 Q TDS on purchase of goods is to be deducted by the buyer within earlier of the following dates-

- At the time of credit into the account of the seller (or)

- At the time of payment

4. Rate of TDS deduction

- The buyers are liable to deduct TDS at the rate of 0.1% of the purchase value above Rs 50 Lakhs.

- If the Permanent Account Number (PAN) of the seller is not available the buyer would be liable to deduct tax @5%.

5. Exemption available under section 194Q-Transactions on which

- TDS is already deductible under other provisions of the Income Tax Act. ( or)

- TCS is collectible as per provisions of section 206C

Some of the important points relating to TDS deductible on purchase of goods:

- TDS is also deductible against any amount credited to the ‘suspense account’ or any other account under the books of accounts of the person liable to make payment of such income.

- Transactions, wherein, TDS is deductible under both the provisions i.e., section 206C(1H) and section 194Q.

- In such cases, TDS would be deductible only under section 194Q of the income tax act.

- Provisions of section 194Q are not applicable when the seller is a non-resident.

- As not specifically mentioned, provisions of section 194Q apply to the purchase of both the types of goods i.e. capital as well as revenue.

Also Read: How to download TDS payment challan 281 in SBI corporate net banking.